jwheeler

Well-known member

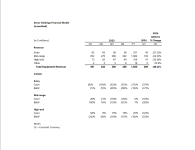

Xerox just released their Q1 financials summary. ¡No bueno!

Q1 2024

Q1 2024

- Revenue of $1.50 billion, down 12.4 percent, or 13.2 percent in constant currency.

- GAAP net loss of $(113) million, or $(0.94) per share, a decrease of $184 million or $1.37 per share, year-over-year, respectively. This quarter includes after-tax Project Reinvention related charges of $100 million, or $0.80 per share.

- Adjusted net income of $11 million, or $0.06 per share, declined by $71 million or $0.43 per share, year-over-year, respectively.

- Adjusted operating margin of 2.2 percent, 470 basis points lower year-over-year.

- Operating cash flow of $(79) million, lower by $157 million year-over-year.

- Free cash flow of $(89) million, lower by $159 million year-over-year.